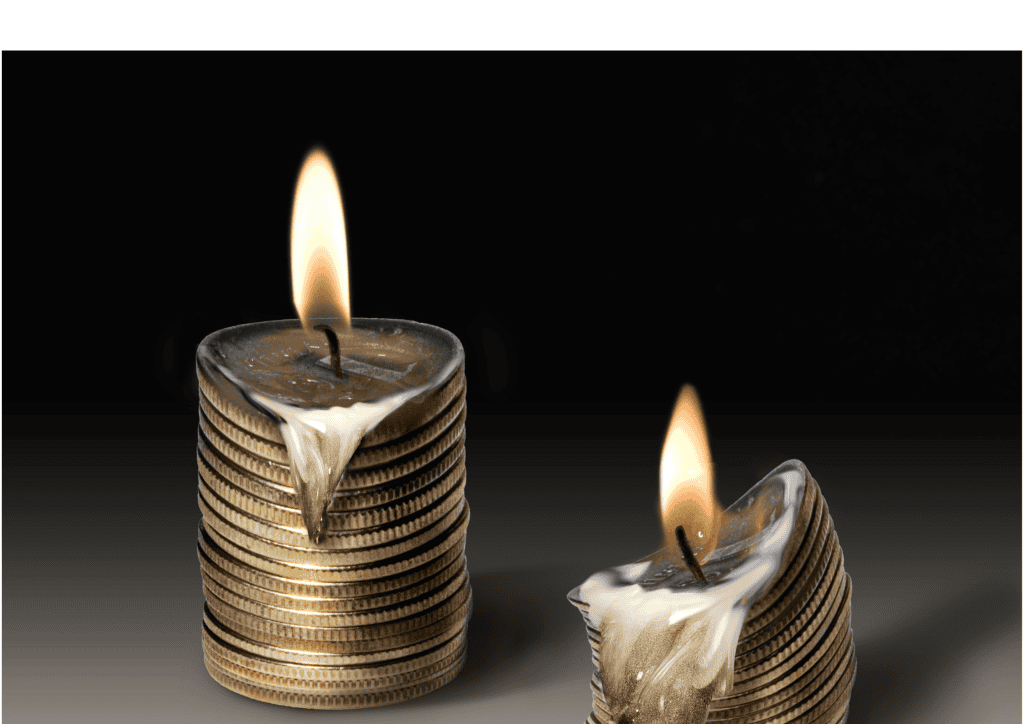

Economic uncertainty and inflation are challenges that we all face at some point. These factors can significantly impact your portfolios, especially those heavily reliant on equities or riskier assets. Fixed income, however, offers a reliable solution for weathering these storms. With stability at their core, these instruments can protect your wealth and provide a steady foundation for your financial future.

At Hestia Trusts, we mitigate the risks of inflation and volatility and capitalise on the opportunities that fixed income provides.

Shielding Your Portfolio from Inflation

Inflation erodes purchasing power, diminishing the value of money over time. This means that returns must outpace inflation to preserve and grow wealth. Fixed income instruments such as inflation-linked bonds (e.g., Treasury Inflation-Protected Securities, or TIPS) are designed to counteract this effect. Their principal value adjusts with inflation, ensuring that your capital’s real value remains intact.

For instance, during periods when inflation spikes unexpectedly, inflation-linked securities provide returns that keep pace with rising costs, thereby preserving your purchasing power. These assets are particularly valuable for long-term planners and individuals relying on consistent income streams, such as retirees or family offices funding multigenerational expenses.

Stability in Volatile Markets

Market volatility, often driven by economic or geopolitical uncertainties, can cause sharp declines in pure equity portfolios. Add in some fixed-income opportunities, which provide a much-needed stabilising force during turbulent times. Their known or predictable returns, achieved through regular interest or dividend payments, ensure steady cash flow when other options are faltering.

Take, for example, corporate or government bonds. These instruments offer a range of risk-reward profiles but consistently maintain lower volatility than equities. By allocating a portion of your portfolio to fixed income, you reduce its overall exposure to market swings and strengthen financial resilience.

Diversifying across fixed-income assets also helps ensure your portfolio is better equipped to handle unexpected shocks. For those of you focused on wealth preservation, this is not just a strategy but a necessity.

Hestia Trusts: Your Partner in Navigating Uncertainty with Fixed-Income

At Hestia Trusts, we understand the unique challenges and goals. That’s why our fixed income strategies are tailored to suit your individual needs, whether you’re focused on climbing inflation or steadying your portfolio during market instability.

- Personalised Solutions: We design fixed income portfolios that balance risk and reward, delivering predictable returns while aligning with your broader financial objectives.

- With years of expertise in fixed-income markets, we ensure your fixed-income opportunities are built to withstand both inflationary pressures and market volatility.

- Dedicated Guidance: Our team is committed to navigating the complexities of the fixed income market for you, so you can focus on achieving your financial goals with confidence.

Secure Your Future Today

The economic challenges we face today are not insurmountable. With a thoughtful approach and the right guidance, you can protect and grow your wealth even in uncertain times. Fixed income remains one of the most effective tools for achieving stability and resilience in your financial strategy.

Partner with Hestia Trusts to explore how tailored fixed income solutions can help you overcome inflation, volatility, and other barriers to long-term success. Contact us today to start building a wealth strategy designed to meet your needs today and tomorrow.